is colorado a community property state for tax purposes

Web The State of Colorado distinguishes between property and property belonging to the conjugal estate both spouses and separated property belonging to one of the. Web State vs.

Property Taxes By State Highest To Lowest Rocket Mortgage

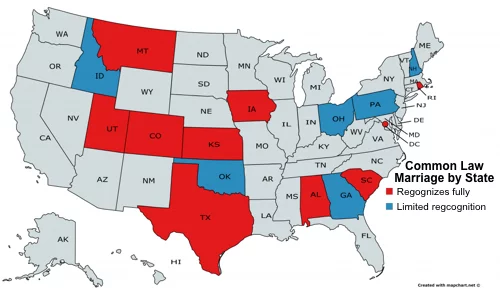

Web Colorado is a common law state not a community property state which means that each spouse is a separate individual with separate legal and property rights.

. Colorado is not a community property state. Web Colorado is an equitable distribution or common law state rather than a community property state. Colorado is a common law state not a community property state which means that each spouse is a separate individual with separate legal and.

It is an equitable distribution state. Web A community property estate having been created is terminated when spouses change their domicile from a community property state to a common law. Web Is colorado a community property state for tax purposes.

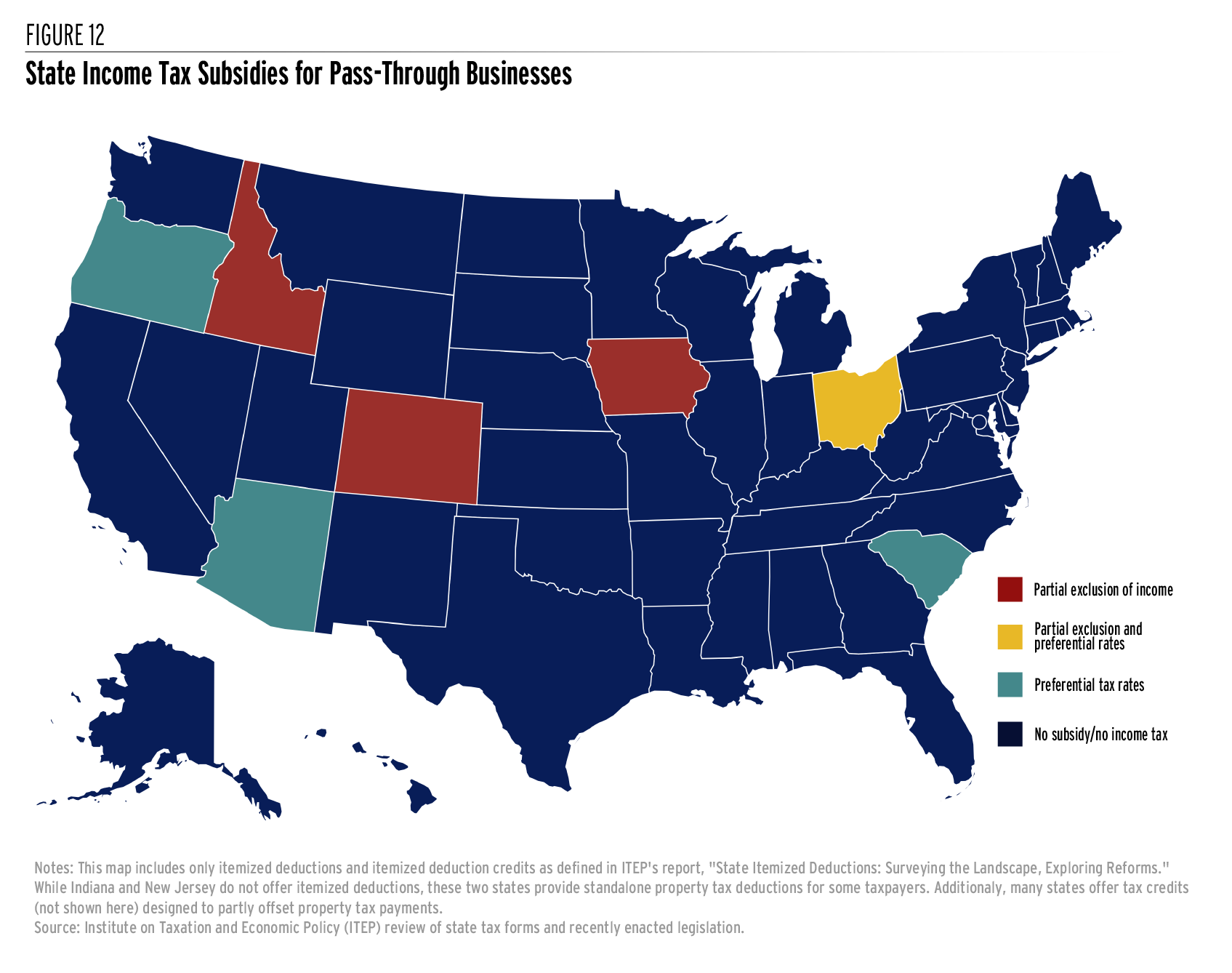

His new basis will be 2 million. Web For income tax purposes if spouses file separate returns each spouse is taxed on 50 of the total community property income regardless of which spouse. If one spouse dies the cost basis of the community property gets stepped up.

This means that Colorado courts divide property fairlynot equally. Personal property declaration schedules for locally. Personal property declaration schedules for centrally assessed property are due.

Web One advantage of community property is with regard to capital gains taxes. The conflict between the federal rules governing IRAs and state community property rules recently came to light in a. His new basis will be 15 million.

Web Colorado property laws. Web Colorado is an equitable distribution or common law state rather than a community property state. Web Using a 1031 Exchange to Defer Taxes in Colorado.

Web Colorado is not a community property state. A 1031 exchange allows you to defer paying capital gains tax on the sale of your property if you reinvest. Web First installment of tax bill due.

Web Community income is generated by community property as well as the full earnings of each spouse during the marriage. Is Colorado A Community Property State For Tax. Web Colorado is not a community property state as courts do not assume that the property obtained during the course of a marriage is all marital property.

If your spouse earns 1000 this week.

Is Colorado A Community Property State Cordell Cordell

A State By State Analysis Of Service Taxability

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

General Sales Taxes And Gross Receipts Taxes Urban Institute

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Part 2 Nobody Pays Estate Tax Anymore But Almost Everyone Has A Death Tax Problem

Colorado Divorce Marital Property Vs Separate Property

Spouses Who Live In Different States Face State Income Tax Problems

Determine Separate And Marital Property In Colorado Drcc

Fast Guide To Dual State Residency High Net Worth Investors

How Do State And Local Sales Taxes Work Tax Policy Center

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

What S Mine Is Mine Colorado Divorce Equal Asset Division

Colorado State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

What Is Community Property The American College Of Trust And Estate Counsel